|

One of the most common questions I've been asked most about Power of Attorney (POA) is, what if I don't have a POA and I become incapable of making decisions for myself? My answer is - you're going to create a lot of trouble for your family or whoever needs to help you to manage your affairs.

When an adult needs help managing their affairs because of mental incapability due to an illness, accident, disability or diseases associated with aging, their judgment may be impaired in some way. They may forget to pay bills or put money away and forget where it is. The adult may also be confused about banking, investments, property, and personal belongings. However, they may have planned ahead and authorized someone else to make decisions and managing their financial and legal affairs through an enduring power of attorney. But what if the adult does not have a POA? British Columbia has been able to develop one of the best land survey and title registration systems in the world.

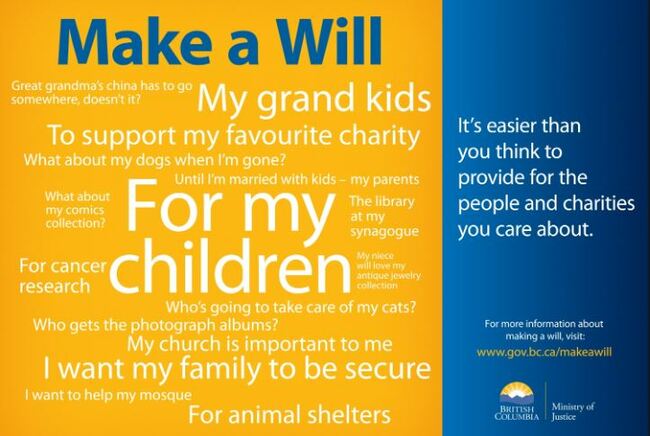

British Columbia, including the colonies before the province came into existence, has always maintained a system for recording ownership and interests in private land. For a short while, the colonies maintained Deeds Registries. However, a Deeds Registry results in a complicated, unreliable system for recording interests in land. In order to gain an opinion on ownership of interests in land, an unbroken chain of documentary evidence over long periods of time or possibly from the original granting of the land from the Crown is required. If any one of those documents was not properly executed, or if all documents in the chain cannot be obtained, then a shadow of doubt is cast upon the claim of ownership. BC Notaries support the Province of B.C.’s proclamation declaring April 7 to 13, 2019 “Make-a-Will Week” and encourage the majority of British Columbian adult who don’t have a current Will to prepare one.

A 2018 survey by Ipsos for the BC Notaries Association found that while 67% of people aged 55 and older have a Will in place, 62% of people aged 35 to 54 and 77% of people aged 18 to 34 do not have a Will regardless of whether they own a home, have dependent children or other important considerations. The British Columbia government has launched the Condo and Strata Assignment Integrity Register (CSAIR) to crack down on tax evasion and improve fairness and transparency in B.C.’s real estate market. It is widely acknowledged that the practice of pre-sale flipping has been lacking of transparency. It is unknown exactly how many assignment flips occur each year. This new register will require developers to add or file assignments on new developments. This information will be gathered securely by the developer. The information that must be reported includes identity and citizenship of all parties to the assignment.

This question has been asked numerous times. And my answer is – it depends on your purpose.

Most parents, as they get older, would want to add their adult children on title of their home to save on probate fee when they pass. Yes, although it is true that you can “save” on probate fee, but it can cost you more financially and have significant legal impact down the road. Most people’s resolutions would include losing weight, exercising regularly, eating healthier so on and so forth. Have you considered getting your estate and personal planning documents in order as this year’s resolution?

Wills, Powers of Attorney and Representation Agreements are the most common and are probably one of the most important documents in your estate plan. Accidents can happen without any forewarning. In the direst circumstances, if you pass away without a will, basically you are leaving up to the law to determine how you want your estate to be distributed upon your death. Your family or closest friends, while grieving for their recent loss, are also required to apply to the Court to be the administrator of your will. In other instances, you suffer sever injury or illness and are not able to communicate with anyone, who’s going to handle your financial, legal, or personal care matters? Your family, even your spouse, would not be legally to handle your matters. In many instances, banks and financial institutions require the borrowers to obtain a title insurance. However, this policy only protects the bank’s interest and insures against financial loss in the event of a defects in title to the property.

In British Columbia, title defects rarely happen. When a land title is transferred, the new owner can be assured that his/her title is “indefeasible” (meaning the title transfer cannot be defeated, revoked, or made void) under the Torrens system, as long as the owner acquires the interest in good faith and for value consideration. In most cases, if you are named as executor of someone’s estate, they are a family member or close friend. So in addition to taking on the role, you’ll also likely be dealing with grief. This checklist provides you a list of things that you should do, and helping you to stay organized while you are dealing with grief.

When a non-resident Seller disposes a real property in Canada, the profit from the sale of the property is, in most circumstances, subject to capital gain. If the Canadian Revenue Agency (CRA) cannot collect its fair share of tax that is supposedly remitted by the Seller, then the Buyer is on the hook and becomes liable for any tax owed by the non-resident Seller.

In order to avoid such situation in a purchase and sale transaction, the Seller’s legal representative must holdback 25% of the sale price for personal use property, or 25% of the land value and 50% of improvement value, prorated from current assessed values to actual price, for income generating property, until a clearance certificate is issued by the CRA. In order to obtain the clearance certificate, the non-resident will need to retain the service of an accountant to apply such certificate. The accountant will work closely with the Seller’s legal representative to ensure that the tax resulted in the disposition of the property is paid to the CRA from the holdback amount. This process can take up to 4-6 months. Complication can arise if there is a mortgage on title. Since the holdback amount is quite significant, there is a chance that the sale proceeds after the holdback is not enough to pay off the mortgage. In such cases, the non-resident Seller will need to come up with extra funds from other sources to pay off the mortgage. To minimize the chance of this happening, the Seller can apply for the Clearance Certificate prior to the completion date, however, this can only be done if there is a subject free contract of purchase and sale. Since the process of obtaining the certificate can take up to 4-6 months, so in an ideal situation there would be a 4-6 months lead time between subject removal and the completion date. In most cases that we see nowadays, subject removal and completion is only a few weeks apart, sometimes days. Therefore, if you foresee such issue happening, please discuss with your lawyer or notary, and your accountant about your situation to ensure you have sufficient funds to pay off your mortgage on completion. When you are looking for a new home or an investment property, you will start by looking at the location and the appearance of the property. But have you thought about the legal status of it and see if there anything on “title” that might affect the property?

In British Columbia, under the Torrens Land Title system, all charges affecting title must be registered on title. There are generally two parts that you can see the legal status of the title: Legal Notations and Charges, Liens and Interests. Under the section called Legal Notations you will find references to documents and legislation that affect title but are not directly charging title. For example, if the property is in the flight path of an airport, you might see a charge that says the property is subject to the Aeronautics Act. Other common notations may make references to

In the section called Charges, Liens and Interests you will find charges that directly affect title. There are two types of charges:

Charges with a notation of “inter alia” apply to more than one property – this is common in strata developments where the charge is registered with each until and applies to the entire complex. It is important to review the title with a BC Notary or a lawyer, as these charges and interests on title might and can affect the use or value of the property. If you need to obtain more information about any of the charges on title, we can help you to order a copy from the Land Title Office. |

welcomeA bit about myself. I am a member of the British Columbia Notaries Public Society. I want to answer some of the most common questions that my clients have through my blog. Hope you find it useful. Archives

April 2019

Categories

All

|

Talk to us today!

HoursMon - Fri: 9:30am to 5:30pm By Appointment Only

Sat: Closed By Appointment Only Sun: Closed |

Email

|

Call

Tel: 604-266-6644 (Eng, 中)

Fax: 604-266-6614 |

Social

|

Copyright © 2019 Jerome Tsang Notary Public | Notary Public, Vancouver BC Notary | Sitemap

RSS Feed

RSS Feed